Highlights- Modest Q4, revenue and margin performance worse than listed peer- Gross margin short of expectations on higher discount sales & low-margin products- Significant cost savings effected, part of it sustainable- Bangladesh capacity ramped up, to cater to entire soft luggage demand- Input inflation and loss of market share to impact near-term margin- Long-term moats intact, ideal stock for patient long-term investors

-----------------------------------------------------------

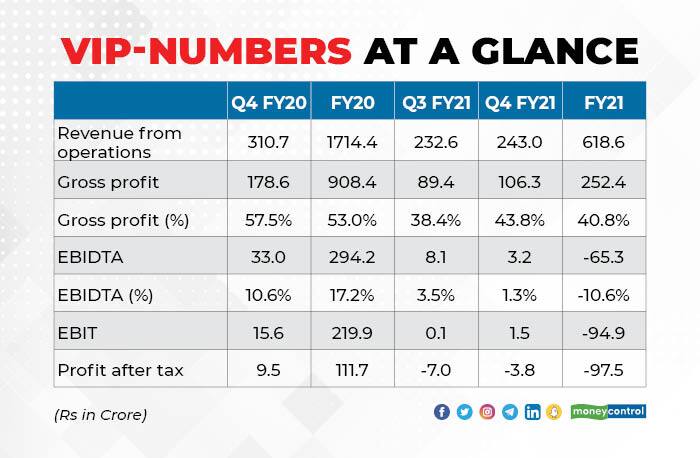

VIP’s (CMP: Rs 366 Market Cap: Rs 5,177 crore) fourth-quarter numbers were shorn of the the stellar show put up by some of the consumer facing businesses in Q4. It ended the year on a subdued note, not only on account of the pandemic but also due to the loss of market share to competition. The margin improvement was much inferior to its listed peer. With the current Q1, the biggest quarter for a luggage company likely to be a washout, the near-term prospects aren’t exciting.

However, the good news is that the company is using this challenging time to bring about some fundamental changes — it has resorted to some meaningful cost reductions that are more structural in nature and hence should support margins once normalcy returns; it has also made a senior management change (appointed new CEO Anindya Dutta, ex Havmor & Britannia) to energise the domestic business and expand overseas. Investors with a long-term view should gradually build up position in the stock for a rewarding journey from FY23 onwards, though we feel Safari is a better bet to play the immediate recovery, possibly marked by down trading.

Earnings picture

Source: Company

While revenue performance was uninspiring with numbers at 78 per cent of the year-ago quarter’s level, the trend line showed improvement — Q1 was 7 per cent, Q2 was 25 per cent and Q3 was 54 per cent of their respective year-ago quarters. The gross margin performance was unimpressive, impacted by higher discounts, sale of low-margin products and the liquidation of old stocks. Overall expense was down by 29 per cent compared with last year — employee cost was lower by 8 per cent & other expenses by 38 per cent. For the full year, revenue was only 36 per cent of last year and gross margin saw a huge decline mainly due to higher discounts, sale of low-margin products, China-sourced products and the liquidation of old stocks.

In sharp contrast, its listed peer reported a Q4 revenue that was 93 per cent of its year-ago level and it sequentially improved its gross margin by 490 basis points to 44.8 per cent while its operating margin saw a 530-basis-point sequential jump to touch 10.1 per cent. The competitor’s better penetration in the budget category could have given it an edge.

While near-term margin pressure is likely for VIP as it tries to recoup market share, in the long term both the organised players should do reasonably well as the post Covid world will render unorganised competition even weaker that had already felt the heat following the implementation of the GST.

The key competitive moats

VIP has effected a significant cost rationalisation in FY21 resulting in savings to the tune of Rs 170 crore of which nearly 50 per cent is sustainable even after full recovery. The company has ramped up capacity in Bangladesh and the entire sourcing in the future will be from there giving it a cost advantage of 15 per cent (duty on Chinese imports). It will also considerably reduce its dependence on China, except for some raw materials. There has been a significant input inflation and the company has taken two rounds of price hikes in selective product ranges. However, given the pressure on demand, the near-term outlook on margin is subdued.

VIP is a net zero debt company and had resorted to borrowing to create liquidity buffer. However, it is going to repay the Rs 150 crore NCD very soon and would rely on working capital for any liquidity deficit.

What’s in store for long-term investors?

Being the second largest luggage player globally, VIP is certainly going to emerge stronger and leaner post the pandemic.

With respect to sourcing, VIP has an edge especially since competitors import the entire soft luggage from China. Bangladesh has lower labour cost and a nil import duty (compared to China), resulting in higher margin and it makes the product price competitive in the export market. The growing preference for hard luggage, which is manufactured in India, is also a positive as these facilities can be ramped up easily and the dependence on China will further go down.

The organised players are already seeing a waning of high-end competition. In fact, small marginal competitors may not have the liquidity to ride out the storm. So market share gains post Covid are likely. Moreover, post the pandemic, a lot of pent-up demand could come back which will be catered to by fewer survivors with strong balance sheet and management bandwidth.

The oligopolistic nature of the industry (with fewer players), favourable long-term macro tailwinds, such as rising income and preference for travel, and the gradual shift in consumer preference for branded luggage (also triggered by the implementation of the goods & services tax) augur well for the organised listed entities. The share of unorganised players is still large, leaving enough headroom for a switch.

Source: Company, Moneycontrol Research

While its listed peer has a robust model to withstand near-term down trading, VIP with a complete product range across price points — VIP, Skybags, Carlton, Aristrocrat, Alfa and Caprese — is ideally positioned to reap the fruits of a complete recovery. Thus any weakness should be used to gradually add this stock for the long term.