Highlights- Company posted in-line results with strong topline and earnings growth

- Second wave of COVID-19 to affect operations in the near term

- Strengthening of distribution network and focus on rural areas key growth drivers

-Strong recovery expected from Q2FY22, once COVID-19 restrictions ease

- Investors with long-term view should add the stock on weakness -----------------------------------------------------------

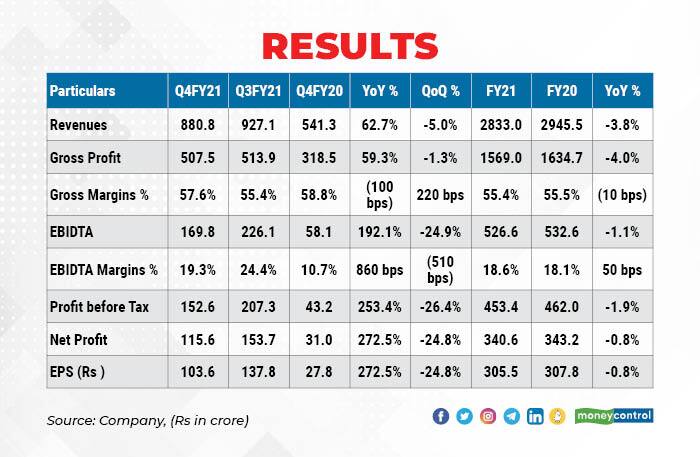

Page Industries (CMP: Rs 31,840; Market Capitalisation: Rs 35,519 crore) posted in-line results in the March 2021 quarter. Considerable easing of restrictions and channel filling, coupled with the low base of the corresponding quarter, led to robust earnings growth.

Restrictions and lockdowns owing to the second wave of COVID-19 would have minimal impact as innerwear is a need-based product and we expect strong recovery, once the restrictions are eased as was witnessed in FY21.

Inroads into the rural sector and robust growth in the kids and athleisure segments are key long-term triggers.

Strong quarter

The trend of strong topline and earnings growth continued in the March 2021 quarter. Page’s revenues grew 63 per cent in Q4FY21, driven by 54 per cent volume growth while the rest was on account of price hikes and better product mix. Further, the opening up of the distribution network, channel filling as well as low base of the last quarter (due to national lockdown) contributed to a strong volume growth.

Gross profit margins dropped 100 bps on a year-on-year (YoY) basis, mainly due to an increase in raw material prices. However, owing to the strong topline growth and the low base of the last year, EBITDA margins improved 860 bps to 19.3 per cent.

Second wave of COVID-19 to hit operations

Page stated that the second wave of COVID-19, from the end of March 2021, is likely to affect the company’s performance. Most states have declared lockdowns/restrictions for 4-6 weeks. Page has shut its manufacturing plant at Bengaluru from the end of April 2021, in the wake of rising COVID-19 infections, although the government had permitted operations with restricted capacity.

Also, the management indicated that about 85-90 per cent of its distribution network is non-operational and it would affect performance.

Strengthening distribution presence, rural growth to be key drivers

Despite the impact on demand due to COVID-19, Page continued to strengthen its distribution reach. In FY21, the company expanded distribution network by about 20 per cent, with about 14,650 distributors and 930 exclusive business outlets. Page added equal number of distributors in both Metro, Tier 1 as well as Tier 2 and 3 towns.

The company will focus on rural areas to drive the next leg of growth. Page aims to significantly strengthen its reach in these areas, given the rising income levels and huge demand potential. It has selected a bouquet of 35-36 product sizes across various price points, which are the fastest-selling. These products will be introduced in the rural areas to fast scale up operations.

Kids, athleisure segments continue to show strong momentum

The recently-launched kids segment (under Jockey Junior) is performing strongly, with the company reporting 80 per cent growth in the division’s revenues in FY21. Page has already launched kids’ products in about 50 cities and aims to rapidly enhance the distribution reach. Page has also opened about 50 exclusive business outlets for kidswear. For the kids category, Page is working on the ‘catch them young’ philosophy, which will enable brand stickiness, once the kids grow up and thus significantly boost sales in the long term.

Page stated that the trend for athleisure products, which started in India about 2-3 years back, has witnessed a sharp acceleration in the times of COVID-19. With the work-from-home culture, people are increasingly preferring casual and more comfortable athleisure products. Page indicated that the athleisure segment reported strong double-digit revenue growth in FY21 as compared to a marginal fall in overall revenues.

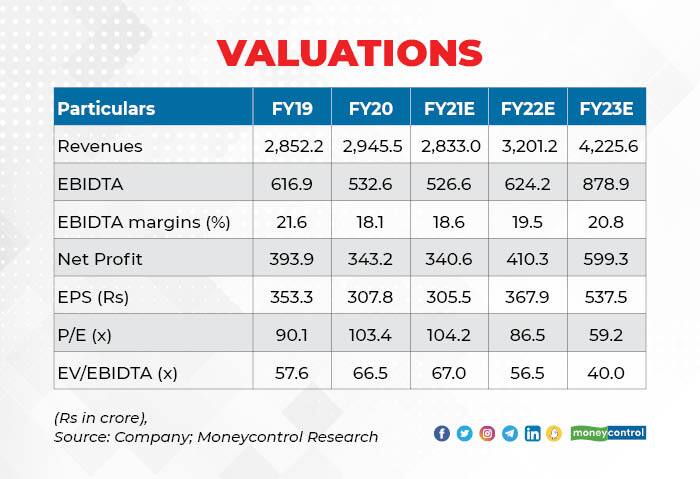

Margin impact temporary, expects to reinstate 21-22% margin level

Page’s margins were impacted in both FY20 and FY21 as the topline was under pressure on account of COVID-19. With strong recovery expected in H2FY22 and FY23, we expect the benefits of operating leverage. Also, Page is focusing on reducing wastage and improving efficiencies, which would drive margin improvement.

Page’s margins in the 9MFY21 period were about 22 per cent and the company is aiming for a margin range of about 21-22 per cent, going ahead. Page stated that rising yarn prices are unlikely to have any material impact as the company has taken about 5 per cent increase in prices and would undertake future increases if required to combat higher raw material prices.

Outlook

The lockdowns and restrictions due to COVID-19 have impacted operations (both manufacturing as well as distribution), and would sharply affect operations in Q1FY22.

However, the innerwear demand is need-based and cannot be postponed beyond a time. We expect strong recovery from Q2FY22, provided COVID-19 cases drop significantly and restrictions are eased. In the last financial year, which saw the first wave of COVID-19, Page saw significant recovery from Q2FY21 as soon as restrictions were eased.

With the low penetration of Jockey brand in innerwear, the management is confident of long-term growth prospects. Increasing depth in urban areas as well as relatively untapped rural areas provide significant growth potential. Page Industries is confident of returning to 15-20 per cent growth in the medium term, once COVID-19 recedes. The management reiterated its target of reaching $1 billion revenue over the next five years, implying a growth of about 20 per cent.

Valuations

At the CMP, the stock is trading about 59x its FY23 estimated earnings, which is close to its long-term historical average. We recommend long-term investors to add the stock on weakness.

For more research articles, visit our Moneycontrol Research page