Highlights

- COVID portfolio ranges from vaccines to monoclonal antibodies

- Growing India presence provides steady cash-flow visibility- Q4 performance gets steady edge from domestic business

- 30+ product launches in FY22 to override pricing erosion in US market

---------------------------------------------------------

Cadila Healthcare’s (CMP: Rs 627, Market Cap: Rs 64,173 crore) COVID-related portfolio is all-pervading. A strong potential to meet the challenges of the second wave of COVID was a key reason for it being a tactical pick in the middle of April’21.

Since then, the stock has been up 25 per cent. This is not surprising, given that Cadila’s domestic formulation sales growth, backed by Remdesivir and other COVID-related products (Heparins, Dexamethasone etc), was 45 per cent in April.

COVID opportunity

But this was not all. The stock was primed by a series of potential rollouts to meet the COVID challenge.

Firstly, Cadila’s COVID vaccine candidate (ZyCoV-D) is undergoing phase III clinical trials and the company expects to file for emergency use approval (EUA) with the Drugs Controller General of India (DCGI) in the next two weeks.

To tap this opportunity, the company’s manufacturing plant would be ready by the end of June and would have a capacity of 1 crore doses per month. Further, in the next 4-6 months, the company plans to have a ready capacity of 2.5-3 crore doses per month, with help from 2-3 contract manufacturers, de-bottlenecking and improvement on yields.

In addition, the company is also conducting pre-clinical trials for measles vector-based COVID vaccine candidate. The management justified having multiple vaccine candidates as the understanding of the virus is an evolving process.

Different bio-technology platforms may help in tackling any future mutant more effectively. Further, on long-term opportunity, the management asserted that pricing, access (thermo stability, dependence on cold chain) and sustenance of acquired immunity would be critical factors.

The management expects that booster doses may be required within a time interval as short as six months.

Cadila has also received EUA from DCGI for Virafin for the treatment of moderate COVID-19 infections. It helps by reducing the supplemental oxygen required.

Virafin is a repurpose drug, Peg-Interferon Alpha-2b, otherwise used for Hepatitis C. As it is a biosimilar, other manufacturers with similar products cannot use it for COVID treatment before proving clinical efficacy. This provides a sufficient first-mover advantage, and, to capitalise this, the company plans to scale up production to 10 lakh doses by July’21 from the current 50,000.

Further, the company is seeking DCGI nod for the human trials of COVID-19 antibody cocktail. It is a cocktail of two SARS-CoV-2-neutralising monoclonal antibodies and can emerge as one of the main treatments for mild COVID-19 by significantly reducing the viral load. It is similar to the one launched by Roche and marketed in India by Cipla.

Beyond COVID, Cadila is also steadily building up its injectable and biosimilars portfolio, which are the areas to look at for the longer term.

Innovation engines: New chemical entities

Cadila is working on multiple new chemical entities (NCEs), of which Saroglitazar is of key interest. This product is now approved in India for both NASH (Non-Cirrhotic Non-Alcoholic SteatoHepatitis) and Non-Alcoholic Fatty Liver Disease (NAFLD).

In the US, the company targets to launch Saroglitazar by FY24 for PBC (Primary Biliary Cholangitis), and, in FY25, for NASH. Both indications are for chronic liver diseases and present a niche opportunity.

Other than this, Desidustat is also undergoing phase III trials in India for the treatment of anaemia in chronic kidney disease (CKD).

Biosimilar growth engine

In case of biosimilars, Cadila is focussing on India and other emerging markets (EMs). It has already commercialised 13 biosimilars in India, including the world’s first biosimilar for Adalimumab.

Now, Cadila is in the process of registering its biologics products in other EMs and targets to have a portfolio of 12–15 products by FY23. It is targeting Bevacizumab, Trastuzumab and Adalimumab in the first phase of launch in EMs.

Recently, the company has launched the world’s first biosimilar Antibody Drug Conjugate of Trastuzumab Emtansine for the treatment of breast cancer in India.

Q4 takeaways

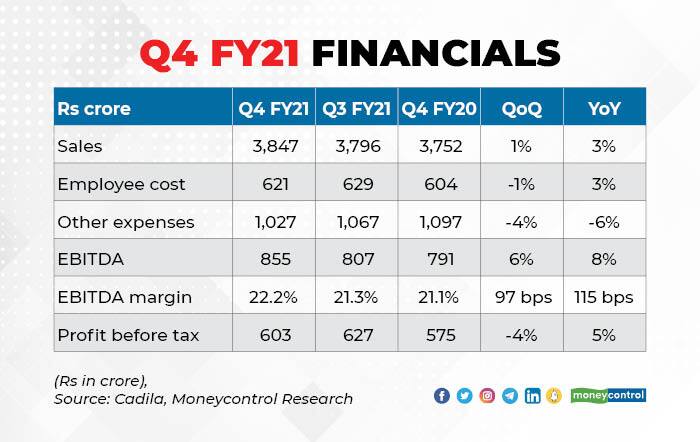

Cadila posted a 3 per cent sales growth, led by a strong traction in domestic formulations (15 per cent YoY) and consumer wellness business (22 per cent YoY), partly offset by a decline in its US business. US business impacted due to weak flu season and a lower traction for key product -Asacol HD - used to treat ulcerative colitis.

EBITDA margins improved due to the containment of employee and other expenses. The management noted that there has been a significant shift in the way digital modes are used for interaction with doctors.

Regulatory front

On the US FDA front, the key near-term challenge is the resolution of the Moraiya plant, for which the company received a warning letter in 2019. Here, about four critical launches are awaited from Moraiya, once the resolution is complete.

Outlook

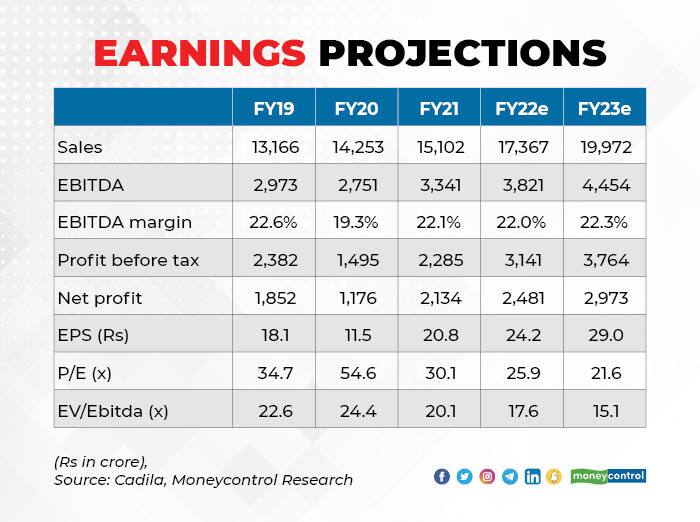

While pricing erosion remains a structural risk in the US market, Cadila is trying to offset it through product launches. In the current fiscal, the company plans to launch at least 30 products, including high single-digit launches of complex molecules. Further, its expanding base in EMs provides an avenue to monetise investments into complex pharma products.

The other supporting factor for Cadila is its growing India presence (~45 per cent of sales), which is similar in size as the US business and provides better cash-flow visibility.

On the balance sheet front, debt-to-equity ratio has gone under 0.25x (vs 0.6x in FY20) after a sharp reduction in debt over FY21.

Here, it is pertinent to note that, recently, the company has entered into an agreement to divest its Animal Healthcare Established Market business for Rs 2,920 crore. While the transaction valuation appears reasonable at 19x EV/EBITDA, the deal helps to bring focus on domestic formulation and consumer health businesses.

Taking account of this deal, potentially, the debt to equity comes to 0.05x only. This provides comfort as the company plans to keep capex in the range of Rs 700-800 crore annually.

Coming to valuations, the stock (15.1x EV/EBITDA FY23e) is trading slightly ahead of its peers such as Cipla and Dr Reddy’s. However, we view the risk- reward is relatively better due to the COVID opportunity and traction in complex pharma pipeline.

For more research articles, visit our Moneycontrol Research page