Sachin PalMoneycontrol Research

Highlights

- Third consecutive quarter of record customer addition in India- Africa business grew 18 per cent in Q4- Consolidated operating margins jumped 500 bps YoY- Rising data use favours higher ARPU in medium term- SOTP valuation signals upside potential

-----------------------------------------------------------

The Covid-19 pandemic, so far, has had a limited impact on most telecom companies' operational performance and balance sheet. Bharti Airtel’s Q4 numbers were no exception as the company delivered a robust quarter amid the pandemic.

Quarterly result highlights

Airtel’s consolidated revenues for the fourth quarter stood at Rs 25,747 crore, an increase of 12 per cent year on year (YoY). Growth came from both new and existing customers and was broad-based across Indian and African markets. Price hikes, premiumisation and cost savings continued to aid operating margins, which increased by more than 600 basis points YoY to multi-quarter highs of 49 per cent.

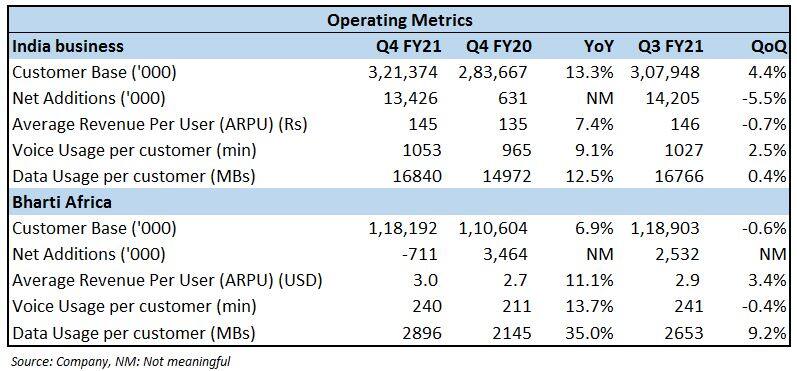

In terms of customer base, the India business saw a net addition of 13.2 million subscribers YoY. With 7.0 million additions YoY, the subscriber base in Africa rose to 118.2 million at the end of Mar-21. The traffic (data+voice+payments) on the network grew across both the markets and the churn rate also dropped compared with last year.

The domestic ARPU (Average Revenue Per User) adjusted for IUC (Interconnection Usage Charge) was largely unchanged quarter-on-quarter, but increased 7 per cent YoY. A significant jump in data use translated into better ARPU for the African market as well. Work from home, home-schooling and streaming entertainment services contributed to higher data use in the quarter gone by.

Outperforming peers in terms of new customers

On the subscriber front, Airtel continues to gain strength from the weak competitive position of Vi (Vodafone India), whose customer base is shrinking almost every quarter. Bharti Airtel continued to surprise positively with the third consecutive quarter of record subscriber addition. Riding on the increasing customer base, Bharti continues to outperform peers and has increased its revenue market share by nearly 400 basis points over the past 12 months. While the debt on the balance sheet is of some concern, Airtel’s operating metrics and cash flows appear healthy and additional efficiency opportunities remain going forward.

Data consumption - a key growth driver

For Q4 FY21, the company’s 4G subscriber base in India has jumped 32 per cent YoY. With people spending more time online amid the pandemic, data use per user has also jumped 12 per cent YoY. The combination of higher data use and the rising share of 4G subscribers will continue to drive the growth in ARPU in the medium to long term.

Long-term trends, such as increasing data consumption, as well as price increases, in line with inflation, will continue to aid top line. The rising penetration of smartphones, affordability, network and content are fuelling data consumption across all platforms. The secular trend in Internet penetration is almost certain to persist and Airtel, with its huge subscriber base, appears to be in a prime position to profit from it.

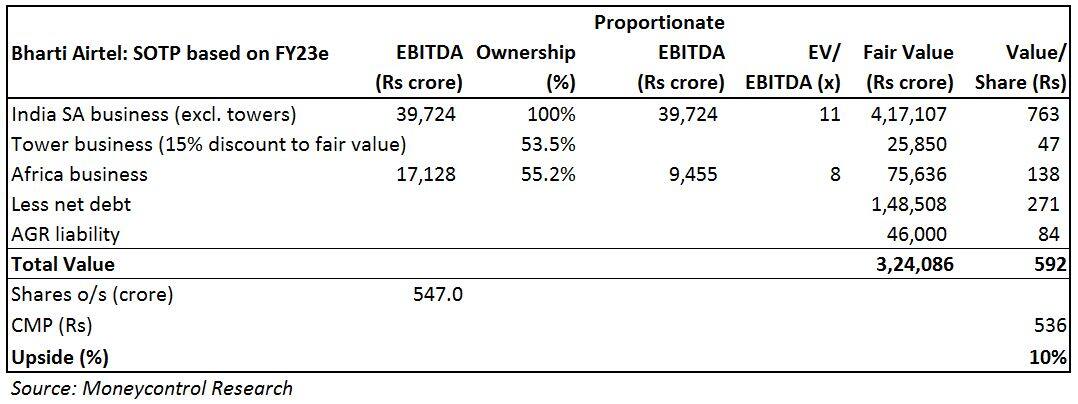

Valuations

The sum-of-the-parts (SOTP) valuation indicates a nearly 10 per cent upside from the current market price. We advise investors to accumulate the stock with a long-term view.

Risks

The pace of new subscriber addition could moderate due to the second wave of the pandemic. Besides, cash crunch in rural pockets may well put a cap on near-term tariff hikes and could also result in the consolidation of multiple SIMs held by a single customer.

For more research articles, visit our Moneycontrol Research Page.